A Blueprint for Britain? How GMPF’s Local Investing is a Powerful Catalyst for Regional Growth

The UK Government’s ‘Fit for the Future’ reforms have set a clear challenge for the Local Government Pension Scheme (LGPS): to scale up local investment and become a cornerstone in driving inclusive, long-term growth across the country. While this new agenda is setting the direction for the entire sector, one fund has been leading the way for over a quarter of a century.

The Greater Manchester Pension Fund (GMPF), the UK’s largest LGPS fund, has maintained a consistent local investment strategy for over 25 years. Our latest independent assessment, GMPF’s 2025 Place-Based Impact Report, reveals how this long-term commitment is delivering tangible benefits for the people and businesses of Greater Manchester and the North West. The findings offer more than just a performance review; they provide a proven blueprint for how patient, place-based capital can generate both financial returns and make a local impact.

The Strategy: A £1.5 Billion Commitment to Place

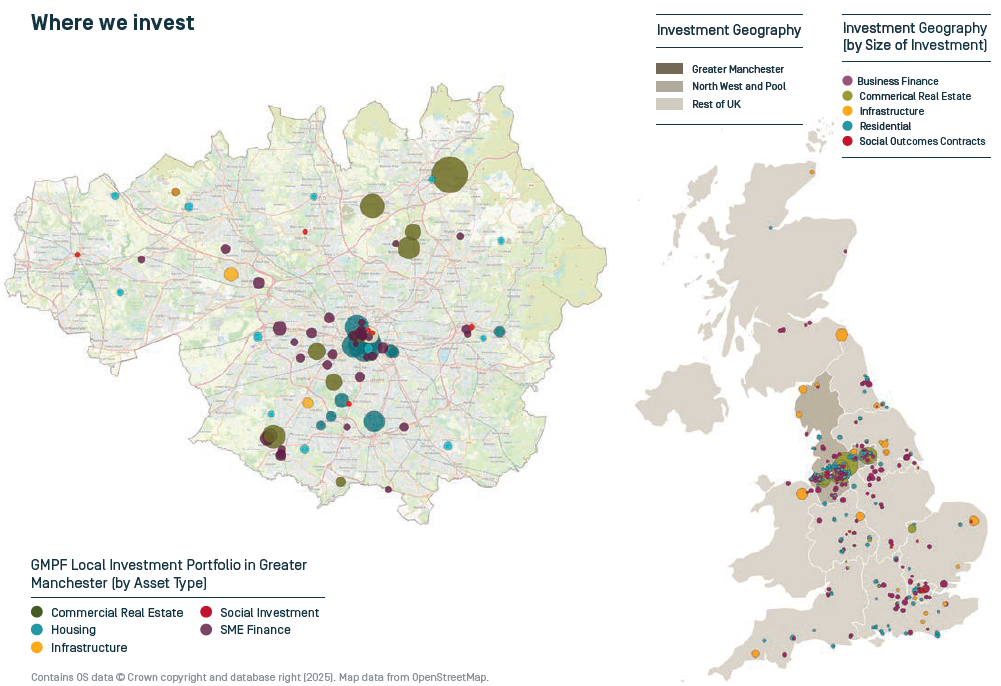

GMPF’s approach is both intentional and strategic. The fund allocates 5% of its total value to a Local Investment portfolio, with ‘local’ defined as Greater Manchester and the wider North West. As of December 2024, this translated to a £1.5 billion commitment, with over £1 billion already invested in the regional economy.

This capital is deployed through two distinct mandates:

- The Greater Manchester Property Venture Fund (GMPVF): Manages direct investments in property developments, from housing to commercial real estate, to spur job creation and regeneration.

- The Impact Portfolio: Invests through expert fund managers in impactful businesses and projects, with core themes of job creation and place-making.

The Impact: Delivering on Jobs, Homes, and Economic Development

Our report analyses the portfolio’s performance against GMPF’s three core impact objectives: Place, Jobs, and Economic Development using The Good Economy’s (TGE) Place-Based Impact Investing (PBII) Reporting Framework. The results demonstrate a powerful alignment with regional needs, as outlined in the Greater Manchester Strategy.

1. Place: Building Resilient Communities

The portfolio is directly addressing local priorities, from the housing crisis to the need for modern infrastructure.

- Housing: Investments have supported the delivery of 3,752 homes, with 75% located in the North West. This includes a diverse range of properties, from affordable housing for low-income families to new apartments designed to attract skilled professionals to the region’s economic centres.

- Infrastructure: The portfolio is enhancing community life by funding seven nurseries with 646 childcare spaces, a primary healthcare facility with a population of 13,500 people, and digital infrastructure connecting over 233,000 premises to broadband.

- Social Outcomes: GMPF has committed £20 million into three social investment funds which enable the portfolio to provide more targeted support to help tackle poverty. Investments are focused on health, education, skills and housing.

2. Jobs: Fuelling the Regional Economy

By targeting finance to underserved SMEs, GMPF is tackling the historic funding gap between the North and London.

- SME Finance: Investments have supported over 15,300 jobs and created 3,923 new roles, with 43% of those new jobs located in the North West. Crucially, 73% of businesses that received funding have demonstrated job growth.

3. Economic Development: Creating Spaces for Growth

Through strategic property development, GMPF is creating the commercial spaces needed for a thriving modern economy.

- Commercial Real Estate: The portfolio includes 22 commercial real estate assets that support an estimated 8,555 jobs. The 489,544m2 of commercial floorspace supported by the fund makes a meaningful contribution to Greater Manchester’s target for new employment space.

A Proven Model for the Wider Sector

GMPF’s local investing success provides invaluable lessons as the entire LGPS sector navigates the government’s new local investing mandate. Its long-established partnerships with the Greater Manchester Combined Authority, local councils and developers demonstrate that deep collaboration is fundamental to creating a pipeline of viable, high impact projects.

The fund’s use of innovative structures, such as co-investment vehicles that incentivise national fund managers to make regional allocations, offers a practical way to direct capital to local priorities without compromising scale or diversification.

Furthermore, the fund has demonstrated its commitment to continuous improvement in impact management and reporting. Following our previous assessments, GMPF has improved its integration of impact measurement and management practices and has begun exploring opportunities to invest in smaller towns across the wider region, not just city centres. This evolution helps deliver more purposeful and inclusive investments that not only align with local priorities but also help to distribute of the benefits of local investing across the region.

As our report concludes: “Positioning GMPF’s model as a proven approach for place-based impact investing offers lessons and strategies for the wider sector, helping to catalyse external investment and broaden the reach of local growth initiatives. Continuous adaptation to regulatory changes and market realities will be critical for sustained success.”

A Call to Action: The Need for a Common Impact Language

The government’s new agenda requires all LGPS pools to report on the scale and impact of their local investments. This presents a critical opportunity to establish a common standard for impact measurement. Without one, we risk a fragmented landscape of incomparable reports that fail to provide a clear picture of the value being created.

The PBII Reporting Framework, which underpins our assessment of GMPF, provides a robust, industry-aligned starting point. It offers a consistent and transparent way to measure impact across different asset classes and geographies.

As the sector moves forward, we invite the industry – LGPS funds, pools, fund managers, and policymakers – to work with us at The Good Economy to build on the current PBII Reporting Framework, ensuring it is fit for purpose for the new regulatory and political-economic landscape. By collaborating on a shared standard, we can ensure that impact reporting is not just a compliance exercise, but a powerful tool for driving better decisions and demonstrating the profound contribution that pension capital can make to building a stronger, more prosperous UK for all.

Related Articles

LGPS Backs Local Investing in Britain

9 September 2025

Pensions for Purpose Joins PBII Network

25 September 2024

Question 7: Can we really measure impact?

9 September 2024

ECF Joins PBII Network

23 April 2024