PBII Reporting Framework

A Proven Framework

Our PBII Reporting Framework is not a theoretical model – it’s an industry-led standard developed in partnership with and already used by pioneering public and private pension funds and asset managers. It provides a robust, repeatable, and cost-effective way to turn your local investment data into clear, credible evidence of your impact.

Built with the industry, for the industry

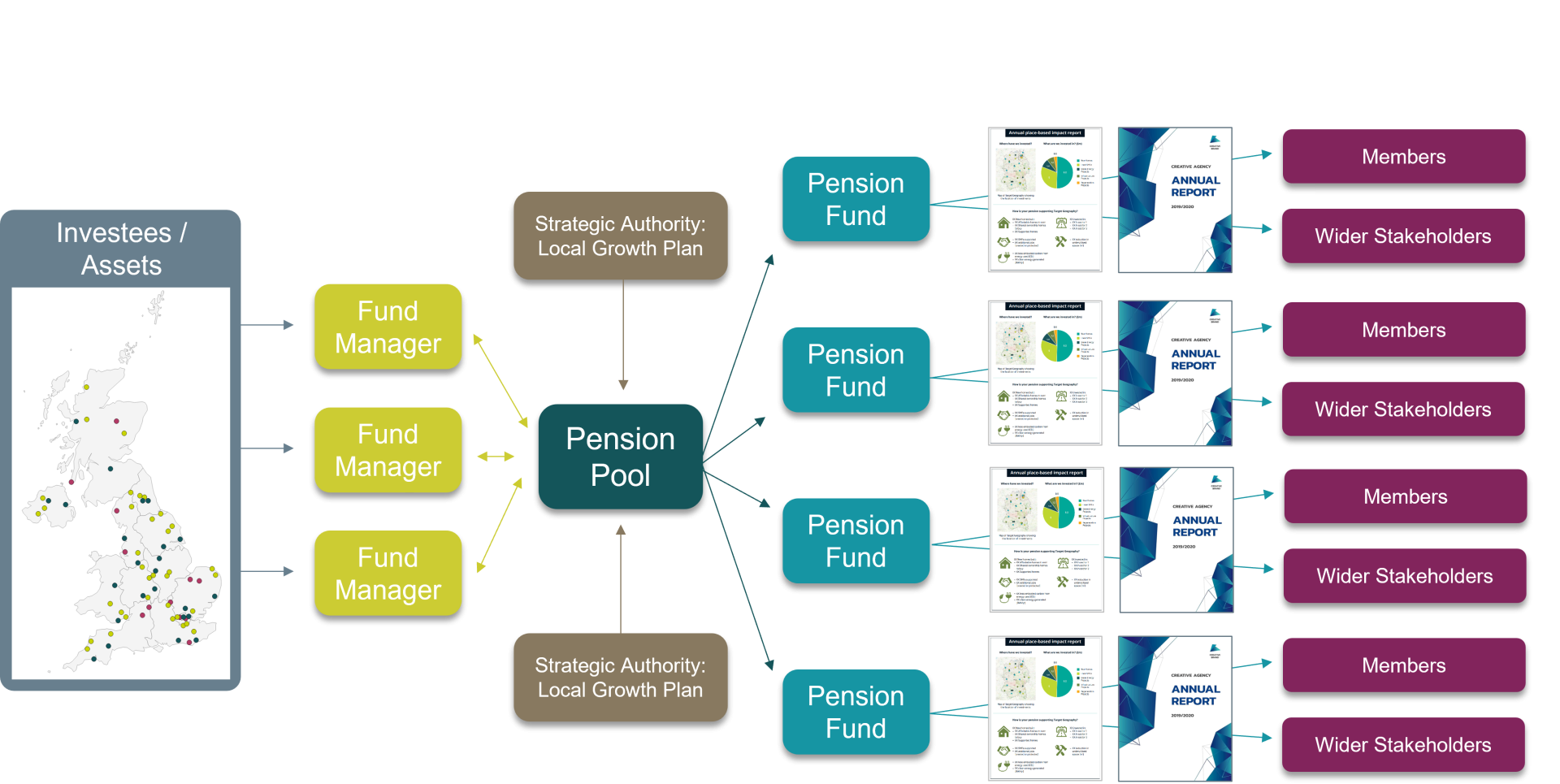

We developed the Place-Based Impact Investing (PBII) Reporting Framework, in partnership with a group of Local Government Pension Funds (LGPS) and asset managers, to provide a common, consistent, transparent methodology for pension funds to report on the impact of their investments.

This reporting approach has now been adopted by progressive local government pension funds including GMPF, SYPA, WMPF, Clwyd and LPFA as well as pools, DC/DB pension funds and even asset managers looking for a place-based view of their local investing activities.

For Asset Owners

Invest with Confidence, Report with Credibility

As stewards of long-term capital, you are under increasing pressure to demonstrate that your investments deliver value beyond financial returns. Our impact reporting service provides the independent analysis you need to meet regulatory mandates, inform strategy, and build trust with your members and stakeholders.

- Strengthen Fiduciary Oversight: Gain a clear, independent view of your portfolio’s geographic footprint and its contribution to local, regional and national growth ambitions.

- Enhance Stakeholder Reporting: Receive comprehensive, board-ready reports and case studies that evidence your commitment to responsible and impactful investment for members, trustees and the public.

- Meet Government Mandates: Our service is specifically designed to help LGPS funds and pools meet the new ‘Fit for the Future’ requirement to report on local investment impact.

For Asset Managers

Gain a Competitive Edge in the Place-Based Era

As institutional investors increasingly prioritise local impact, our PBII Reporting service helps you meet this demand and turn it into a strategic advantage. We provide the independent evidence you need to win mandates, strengthen investor relations, and lead the market.

- Differentiate Your Strategy: Receive an independent assessment of your fund’s place-based traits and impact focus, clearly articulating your unique value proposition in a competitive market.

- Win LGPS Mandates: Demonstrate a robust, credible, and independent approach to place-based impact that aligns directly with the new procurement and reporting requirements of LGPS Pools.

- Strengthen Investor Communications: We provide clear, investor-ready factsheets and portfolio analysis that evidence the sub-national impact your fund is delivering, helping you to build trust and deepen relationships with LPs.

LGPS Local Investment Reporting

The government’s ‘Fit for the Future’ reforms now require all LGPS pools to report on the extent and impact of their local investments annually. Our industry-led PBII Reporting Framework provides the proven, credible, and consistent solution you need to meet this mandate with confidence.

The Challenge

The government has set a clear expectation: pension capital must play a role in driving local growth. For LGPS Pools and their Administering Authorities, this brings a new era of accountability and complex reporting. Without prescribed metrics, how do you consistently measure and demonstrate the real-world impact of your investments in a way that is both meaningful and efficient?

Meet Regulatory Requirements

Confidently fulfil the new government mandate with a framework that aligns directly with policy expectations for demonstrating the scale and impact of local investments.

Save Time and Resources

We do the heavy lifting - from data gathering across your private market portfolio to analysis and report production - freeing up your team to focus on strategy.

Ensure Consistency and Comparability

Adopt a common standard for impact, allowing for consistent reporting across your partner funds and clear comparison across the LGPS sector.

Communicate with Credibility

Receive board-ready factsheets, dashboards and case studies that clearly and powerfully communicate the value of your investments to members, stakeholders and the public.

Scaling-Up Local Investing for Place-Based Impact

Coming Soon

Our new white paper provides a strategic framework and practical guidance for LGPS, institutional investors, and public authorities on turning the local investing agenda into a national reality.

Get in Touch

"*" indicates required fields