PBII Reporting Framework gains traction with release of ‘Investing in the UK’ report from the London Pensions Fund Authority

The London Pensions Fund Authority (LPFA), a £7.8 billion Local Government Pension Scheme (LGPS) Fund, recently released its inaugural ‘Investing in the UK’ report, developed in partnership with The Good Economy (TGE) and Local Pensions Partnership Investments. The report uses the PBII Reporting Framework which offers a comprehensive overview of the geographical distribution and specifics of the Fund’s UK real estate and infrastructure investments.

Read full report here

The Place-Based Impact Investing (PBII) Reporting Framework was developed by TGE with a group of LGPS and asset managers to provide a common, consistent, transparent methodology for pension funds to report on the impact of their investments. This reporting approach has now been adopted by progressive local government pension funds including the LPFA, South Yorkshire Pension Fund (SYPA), Clwyd Pension Fund and Greater Manchester Pension Fund (GMPF).

PBII Reporting Framework

The PBII Reporting Framework uses TGE’s conceptual model of PBII which was unveiled in seminal white paper Scaling Up Institutional Capital for Place-Based Impact, published with the Impact Investment Institute and Pensions for Purpose.

TGE helped the LPFA to quantify the positive environmental and social impact in places and communities across the country resulting from their investments. Even though the LPFA is not an ‘impact investor’, they recognise the role that TGE’s PBII Reporting Framework can play in directing UK pension money to deliver more inclusive and sustainable development at home – as outlined in the white paper.

LPFA Place-Based Investments

TGE analysed data provided by LPFA’s fund managers with high levels of exposure to the UK, accounting for 64% (£1bn) of the Fund’s Real Estate and Infrastructure portfolio. Key findings include:

- Around 13% of LPFA’s portfolio is already invested in local communities around the UK

- The LPFA is invested in over 250 properties, ports, hotels, warehouses, trains, wind and solar farms and other assets across the UK.

- Over 70% of their UK infrastructure and real estate investments by value are outside London.

- They are invested in over 100 clean energy investments, most of which are in Wales, Scotland and the East Midlands.

- 80% of the LPFA’s housing investments by value are in London with the rest in the South East.

Robert Branagh, CEO of the LPFA, emphasised, “This report demonstrates the profound impact of our Fund on communities and regions throughout the UK, driven by our investments in tangible assets: Infrastructure and Real Estate. Identifying the locations of our physical investments is essential for robust risk management, especially as the effects of climate change escalate. We are also committed to facilitating a Just Transition and recognise the Government’s commitment to Levelling Up and the importance of contributing to the debate on these issues by understanding what is already taking place. Transitioning to a low carbon economy is imperative, and it must be executed in a manner that prioritises fairness and inclusivity, while fostering meaningful employment opportunities and ensuring that no one is left behind.”

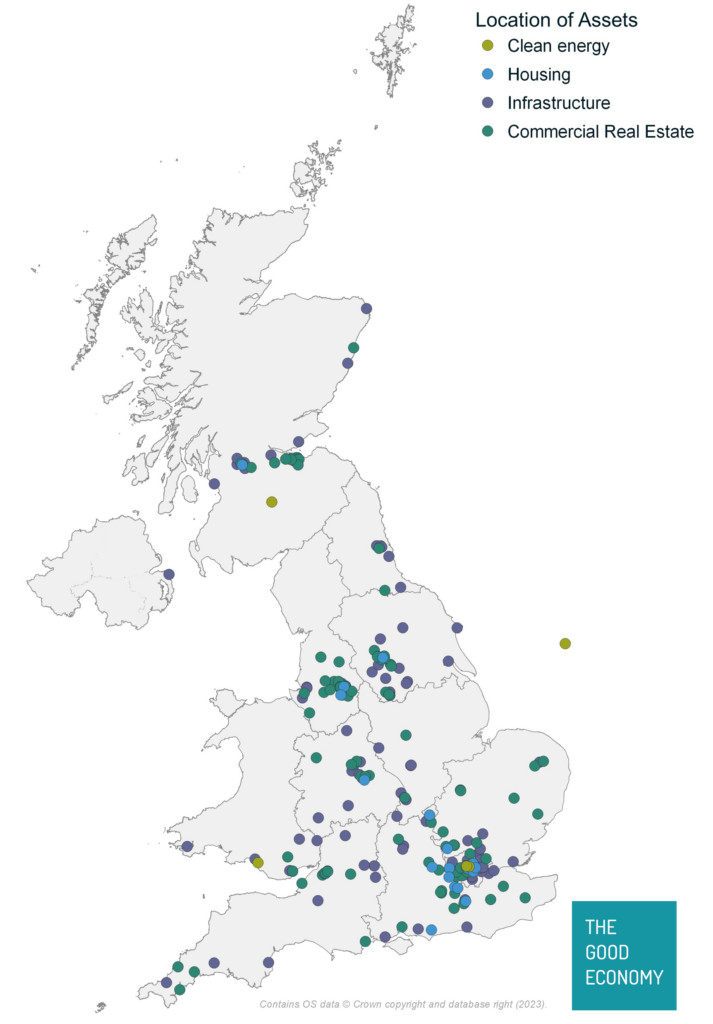

Distribution of LPFA UK Assets

The map below shows more detail on the location of the LPFA’s investments split by asset class including Clean Energy investments (for example, wind farms and solar farms), Housing (student and affordable), Commercial Real Estate and Infrastructure (from transport and water companies to ports and schools).

Sarah Forster, co-Founder and CEO of The Good Economy, said: “We are delighted to be working with the LPFA on this multi-year PBII Reporting partnership and commend them for their commitment to sustainable, place-based economic development in the UK. We believe place-based impact reporting will become the norm in a few years as pension funds respond to public interest in understanding how their money is invested. Individual savers and investors, including local government pension scheme members, are increasingly asking how their money is making a meaningful difference and contributing to tackling the UK’s regional and social inequalities.”